Category: Markets

-

Bonds Are Back

Bonds have not been a thing for a minute now. They have been boring for my entire financial career, offering negligible returns. A quick Google search for “bonds” will bring results for James and Barry, not the $46 trillion fixed-income market. When bringing up bonds in meetings with clients and prospects the past few months…

-

What. A. Year.

Financial markets are always a little weird. After all, financial markets reflect the behavior and sentiments of people, especially in the near term. Investors have experienced sentiment all over the place the past few years, from bleak circumstances to euphoric speculative nonsense, and back again. 2022 will probably go down as one of the market’s…

-

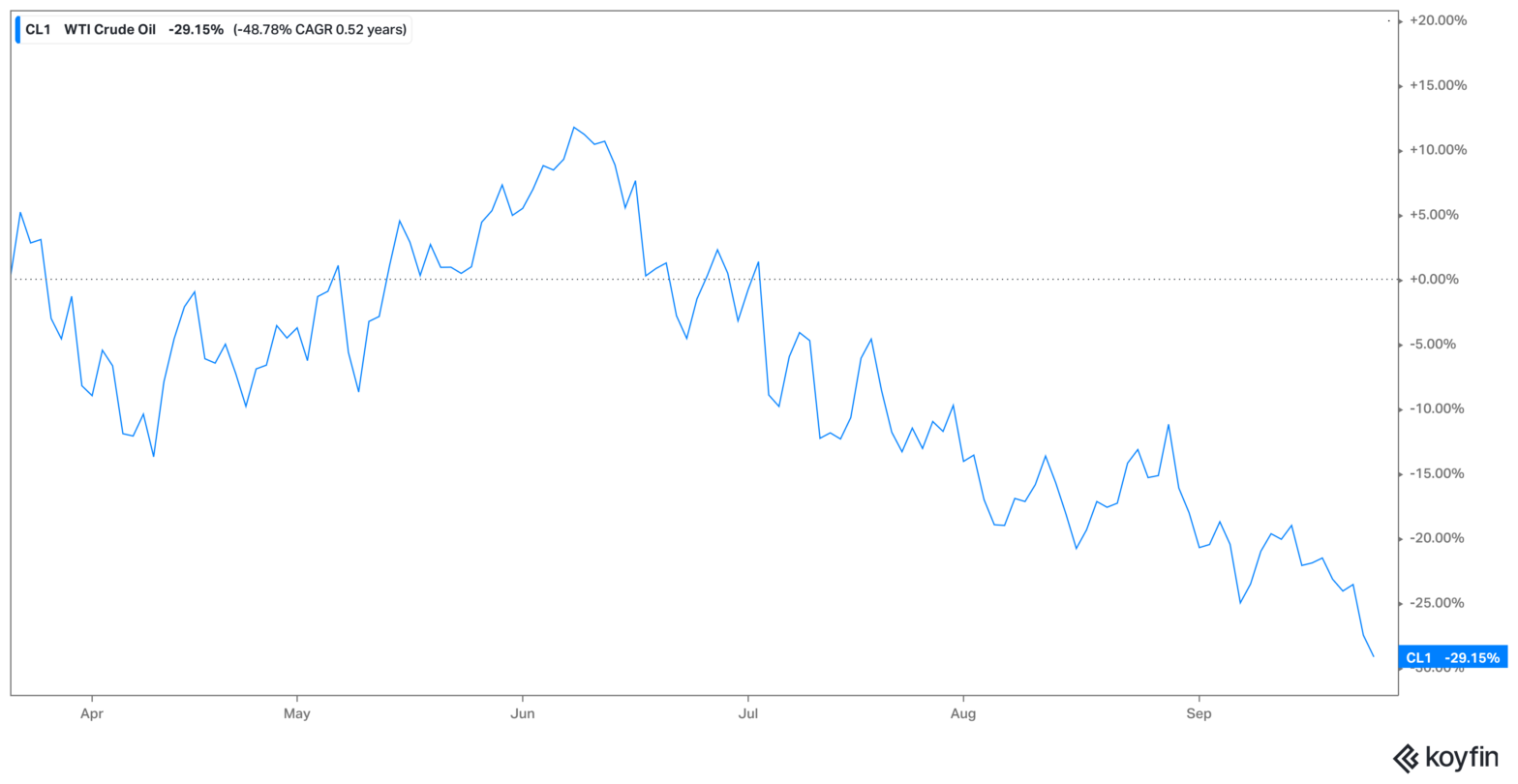

Using the Strategic Petroleum Reserve To Fight Inflation

The inflation numbers for August came in hotter than expected, rising 0.1% for the month against the falling forecast. On the surface, it does not seem too bad, considering inflation is over 8% for the year, and it paused in July. The Fed and investors were by far and away hoping that they had seen…

-

What A Year This Quarter Has Been

It has been a difficult quarter for investors. Major indexes entered bear territory (means down 20%). US treasuries, generally the safest of assets for when investors are scared, have had their worst year since the 70s (when interest rates go up, bonds go down). Commodities, which I generally say “they suck until they don’t,” have…

-

Politicians Can’t Do Much About High Oil Prices

The price of oil is surging, and so is the debate over what is causing the fastest runup in recent memory. As we approach the midterm elections, candidates and the broader media will continue to discuss gas prices and inflation. What has caused the surge in oil prices, and can policymakers do anything about it?…

-

401(k) Down? Blame Facebook

Facebook (I still refuse to call it Meta) has had a rough few months. Its stock has fallen over 40% since November. That is a phenomenal drop, especially for a company in the top ten of the S&P 500 Index. The size of Facebook and its plummet have helped drag the S&P 500 Index down…